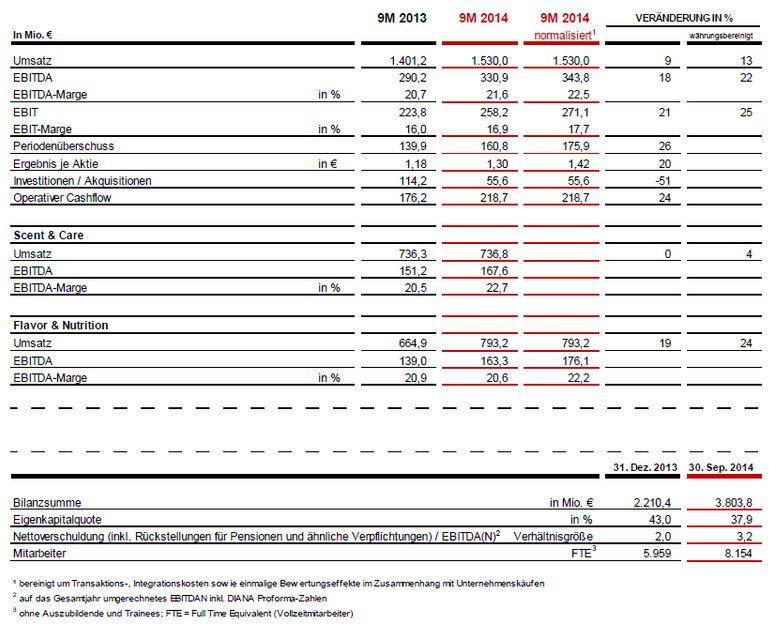

Symrise Continues on Profitable Growth Track

- Group sales increase by 13 % at local currency to € 1,530 Million

- First time consolidation of Diana Group in third Quartiers

- EBITDAN rises 18 % to € 343.8 Million

- EBITDAN margin increases to 22.5 %

- Integration of Diana Group proceeding as planned

- Outlook confirmed

Symrise AG considerably increased its sales and earnings in the first nine months of 2014. The Group benefited from high demand in both segments and all regions. For the first time and as of July, the consolidated financial statements also include the results of Diana Group, which was acquired in spring. Symrise thus increased its Group sales by 13 % at local currency to € 1,530.0 million in the reporting period (9M 2013: € 1,401.2 million). Earnings before interest, taxes, depreciation and amortization as normalized for one-time effects from the acquisition and integration of Diana (EBITDAN) increased by 18 % to € 343.8 million (9M 2013: € 290.2 million). The EBITDAN margin rose to 22.5 % (9M 2013: 20.7 %).

Symrise AG

Dr. Heinz-Jürgen Bertram, Chief Executive Officer of Symrise AG, said: “Symrise is very well on track and in great shape. In the first nine months of the year, we successfully used market opportunities, systematically pursued our strategy and further expanded our market position. The Diana Group has been part of Symrise since July and we are successfully combining our activities. This will allow us to offer a much broader portfolio in the future and to make ourselves stand out in the market even more. We therefore consider Symrise in a good position for the remaining weeks of this year and also the future.”

Sales Growth in all Regions

Symrise increased its sales by 9 % in the reporting currency to € 1,530.0 million in the first nine months of the year (9M 2013: € 1,401.2 million). At local currency, this amounts to 13 % growth. All of the regions and both segments contributed to the Group-wide increase in sales, as did the acquisition of the Diana Group.

Latin America was the most rapidly expanding region with a sales increase of 20 % at local currency, followed by EAME with a 14 % sales increase at local currency. Symrise grew sales in North America by 13 % at local currency. The Asia / Pacific region increased its sales by 7 % at local currency.

High Profitability with an EBITDAN Margin of 22.5 %

The focus placed on high-margin business, unwaveringly high capacity utilization and continued cost discipline significantly contributed to the Group’s increased profitability. One-time effects in the amount of € 12.9 million were incurred in relation to the acquisition and integration of the Diana Group. These were allocated to the Flavor & Nutrition segment. Earnings before interest, taxes, depreciation and amortization as normalized for specific effects (EBITDAN) increased by 18 % to € 343.8 million in the first nine months of the year (9M 2013: € 290.2 million). At local currency, this equates to an increase of 22 %. The normalized EBITDA margin increased by 1.8 percentage points to 22.5 % (9M 2013: 20.7 %).

The financial result includes acquisition-related one-time expenses amounting to € 7.8 million. In addition, write-downs on intangible assets from the Diana transaction had not yet been taken into account in the third quarter, as their revaluation (purchase price allocation) had not yet been completed. The net income for the period as normalized for these specific effects increased by 26 % to € 175.9 million in the reporting period (9M 2013: € 139.9 million); the normalized earnings per share increased accordingly, from € 1.18 to € 1.42.

Significant Increase of 24 % in Cash Flow from Operating Activities

Cash flow from operating activities rose by 24 % to € 218.7 million (9M 2013: € 176.2 million). This sharp increase can be attributed to the higher net income for the period and a below-average rise in working capital. The ratio of net debt to EBITDAN amounted to 2.4 (December 31, 2013: 1.1). Taking pension liabilities into account, the ratio amounted to 3.2 (December 31, 2013: 2.0). With an equity ratio of 38 % Symrise continues to operate on the basis of a strong balance sheet.

Sales in Emerging Markets grow by 12 %

Symrise continued to benefit from high demand in Emerging Markets. Sales in those markets grew by 12 % in local currency compared to the prior-year period. The share of sales from Emerging Markets amounted to 47 % (48 % in local currency) of Group sales.

Scent & Care Segment

Sales in the Scent & Care segment amounted to € 736.8 million and were thus at the same level as the previous year’s figure (9M 2013: € 736.3 million). The previous year’s high figure, was characterized by double-digit growth and was gratifyingly equalled. The segment also further concentrated on high-margin business. In local currency, sales rose by 4%; strongest growth came from the Life Essentials division.

Scent & Care grew its EBITDA by 11 % to € 167.6 million (9M 2013: € 151.2 million). The EBITDA margin increased by 2.2 percentage points to 22.7 % (9M 2013: 20.5 %).

Flavor & Nutrition Segment

Flavor & Nutrition increased sales by 19 % to € 793.2 million (9M 2013: € 664.9 million). At local currency, this corresponds to growth of around 24 %. For the period, July to September Diana contributed € 115 million to sales and achieved a sales increase of 9 % year on year. Without the effects of this acquisition, Flavor & Nutrition grew sales by 6 % at local currency.

The segment’s EBITDA normalized for one-time effects rose to € 176.1 million in the reporting period (9M 2013: € 139.0 million). The normalized EBITDA margin increased to 22.2 % (9M 2013: 20.9 %).

Positive Outlook for the Fourth Quarter

Symrise expects to see good momentum in both of its business segments in the remaining weeks of 2014. Although political conflicts will continue in some countries the Group expects robust demand in all regions. Accordingly, Symrise is confirming its goal of growing faster than the global market for fragrances and flavors in 2014 also and of achieving an EBITDA margin of more than 20 %. The objectives defined for the 2020 fiscal year also apply to the Group as expanded by the addition of the Diana Group and continue to be valid: Symrise aims at a compound annual growth rate (CAGR) of between 5 and 7 % and an EBITDA margin in the range of between 19 to 22 %.