Financial statements 2015/2016: Earnings better than expected

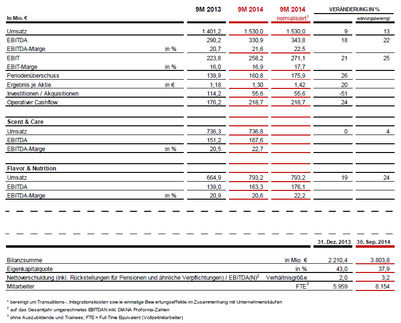

- Net income of EUR 15 million

- Revenue down by 14 per cent to EUR 1,607 million

- Higher equity ratio

- Dividend proposal of EUR 0.10 per share

Nordzucker closed the 2015/2016 financial year with a slightly positive result of EUR 15 million. In a very demanding market environment, the Group therefore performed better than had been expected at the beginning of the year. Key earnings drivers were the slight recovery in sugar prices, sales of bioethanol, the efficiency gains realized across the Group as a result of the efficiency programme FORCE as well as non-recurring effects. For the current financial year, the sugar producer is expecting revenues to remain largely at the current level, but earnings to improve.

Nordzucker generated consolidated revenues of EUR 1,607 million in the 2015/2016 financial year (reporting date: 28 February), almost 14 per cent lower than in the previous year (EUR 1,866 million). The operating result (EBIT) came to EUR 16 million (previous year: EUR 26 million) and consolidated net income fell again year on year to EUR 15 million (previous year: EUR 20 million).

Altogether, the earnings situation is not satisfactory, but it is still well above the original expectations for the year. “The past financial year was more than challenging. We worked hard for this result. My thanks go to all the colleagues who made it possible under difficult conditions”, said Hartwig Fuchs, CEO of Nordzucker AG, at the press conference to present the financial statements in Braunschweig. “This year, we will again propose a dividend of EUR 0.10 per share at the Annual General Meeting.”

Sugar revenue up on the year

Worse harvests around the world led to a reduction in sugar stocks across the board. At the same time, the volume of sugar produced in the EU fell sharply compared with 2015 due to significant reductions in land under cultivation. Restricting supply brought about a slight improvement in prices on the sugar market. The company’s successful market positioning and higher revenues, also due to higher sales of quota sugar, improved earnings in the last few months of the financial year.

A fall in demand for mixed animal feed across Europe as a result of the all-round tense situation on the milk market had a significant impact on sales of sugar beet pellets and cossettes. Prices and sales were both down as a result. Sales of molasses improved slightly year on year, however.

Bioethanol makes positive contribution

The bioethanol business performed significantly better than in previous years. This was due to a sharp increase in prices, which the company took advantage of by significantly scaling up its production.

Lean processes and efficient structures

The wide-ranging FORCE efficiency programme, which was launched in early 2015 and covers all aspects of the business, from crop planning to customers, delivered significant successes in its very first year. In future, it is expected to generate annual cost savings of at least EUR 50 million as well as further efficiency gains.

Non-recurring effect: repayment of interest on production levy

A positive one-off effect came as a result of a court ruling ordering the repayment of interest on production levies already paid.

Solid capital structure: basis for growth and investment

Equity went up to EUR 1,278 million (previous year: EUR 1,272 million). The equity ratio also improved to 63.5 per cent (previous year: 59.3 per cent), which is well above the target figure of 30 per cent. The company remains debt-free, and its net capital investments went up significantly to EUR 164 million.

Nordzucker continues to invest sustainably to maintain and improve the productivity of the Group’s plants. Some investments were postponed in the year under review, but capital expenditure still came to EUR 60 million. In the current financial year, the company is planning to invest another EUR 82 million. Expenditure will focus on optimizing warehouse capacities, logistics and customer deliveries, as well as on further reducing energy consumption in the plants.

Change begins in the mind

“Across the Group, we have initiated pioneering measures to ensure that the transition to 2017 is a success”, emphasizes Fuchs in reference to the motto for this year’s press conference on the financial statements. “The era of defined quotas and minimum prices is over; commercial success will be decided solely by market and customer focus and efficiency in future – and we are systematically preparing ourselves for that.”

Outlook

Beet farming remains attractive. Increases in yields per hectare and flexible contracts will boost profitability. Future terms for beet farmers will reflect the new market situation and be competitive in comparison with other crops. At the same time, Nordzucker is giving priority to long-term visibility: the Group will base its volume planning on the market and not just rely on expanding the land under cultivation.

For the 2016/2017 financial year, Nordzucker is forecasting revenues on a par with the previous year. Savings from the FORCE efficiency programme, relatively low energy prices and slightly higher sugar revenues should nonetheless contribute to higher earnings than in the reporting period.

Nordzucker will continue its growth strategy. The company intends to seize the opportunities created by the consolidation of the EU sugar market and also to grow in the sugar market outside of the EU. Investments in related agricultural markets will also be considered.

“We are a large, solidly financed company, and we will use our opportunities to give our shareholders a dependable return on their capital”, says Fuchs with conviction.