Price inflation and higher production costs drive Olive Oil market up to €3bn

European Shoppers focus more on quality than price with Olive Oil purchases as volume sales decline – IRI analysis

Advertisement

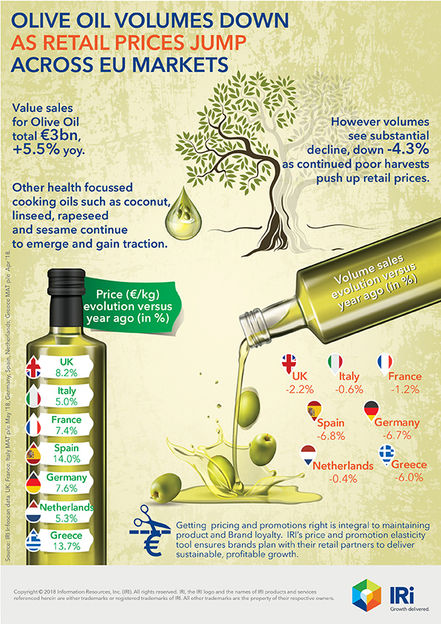

Poor harvest conditions continue to provide a challenging backdrop to the olive oil market, according to the latest analysis of value and volume sales across Europe (UK, France, Germany, Greece, Italy, Spain and the Netherlands) by IRI, the big data and technology expert for consumer industries.

Country-level trends Country level data (UK, France, Germany, Greece, Italy, Spain and the Netherlands) for Olive Oil and Olives is available upon request – including €MAT value sales, value sales vs. a year ago (%), price (€/kg) evolution vs. a year ago (%) and volume sales vs. a year ago (%).

IRI

While six of the seven countries analyzed post value sales growth close to 6% year on year (yoy), thanks to higher material costs and price inflation across the region, all markets show volume declines in the last year (UK, FRA, ITA - MAT p/e May '18, DE, ES, NL, GR - MAT p/e Apr '18). The most notable volume decline is in Spain (-6.8%) followed by Germany (-6.7%) and Greece (-6.0%). The Netherlands and Italy show the smallest volume declines at -0.4% and -0.6% respectively.

According to IRI’s analysis, the European Olive Oil market overall is worth €3bn, with Extra Virgin Oil managing to stave off decreases in volume yoy, potentially helped by lower price inflation rates compared to the overall category. Extra Virgin now contributes €1.2bn, while Standard Olive Oil contributes around three-quarters of a billion Euros.

Notably, Organic Olive Oil has grown by 37.4% in value and 17.5% in volume in the UK market compared to a year ago, thanks in part to shopper perception about the health benefits, although overall sales in this segment are still low.

The Olives market shows a similar pattern, according to IRI, with six of the seven countries posting value growth close to 6% yoy, but all markets showing volume declines in the last year. Green olives dominate across Europe, yet black olives show stronger underlying growth more consistently.

“Olive oil prices have risen substantially, as poor harvests and challenging economic conditions have impacted the price of raw materials and production costs by as much as 13% or 14% in countries like Greece and Italy,” comments Olly Abotorabi, Senior Regional Insights Manager at IRI.

“As a result we’re seeing a very interesting picture of the current state of the market, with volume declines in all markets, but value increases versus a year ago. High shelf prices are starting act as a deterrent and prompt consumers to try other cooking oils. In Germany, for example, we see high strong volume growth for Linseed Oils at +18% yoy albeit from a smaller base, while lower prices for sunflower oil appear to be bolstering its fortunes, volumes up +10% yoy.

“Looking to the future, a better harvest and production will help re-stimulate growth prospects. However, Olive Oil will continue to face increasing competition from alternative oil types like sesame, rapeseed and coconut oils.”

IRI also anticipates that Olive Oil manufacturers will come under increasing pressure about packaging. While plastic bottle formats do well across key European markets, they will be susceptible to more environmental focus, consumer pressure and changing retailer focus.

Similarly with Olives, the growth in healthy snacking across Europe, as identified in a recent IRI report will see more innovative packaging like pouches aimed at consumers looking for ready to eat options.

EU producing countries account for 70-75% of world production of olive oil and more than one third for table olives (European Parliament Think Tank).