Kraft Heinz Announces Agreement to Sell Its Natural Cheese Business to Groupe Lactalis

Transaction Expected to Close in First Half of 2021, Subject to Regulatory Approvals

The Kraft Heinz Company (Nasdaq: KHC) (“Kraft Heinz” or the “Company”) announced today that it has entered into a definitive agreement to sell its Natural, Grated, Cultured and Specialty cheese businesses to a U.S. affiliate of Groupe Lactalis for a purchase price of $3.2 billion USD. The proposed transaction is expected to close in the first half of 2021, subject to regulatory review and approval.

Kraft Heinz

The transaction includes Kraft Heinz’s Natural, Grated, Cultured and Specialty cheese businesses in the U.S., Grated cheese business in Canada, and the entire International Cheese business outside these two countries, including the following brands: Breakstone’s, Knudsen, Polly-O, Athenos, Hoffman’s, Cracker Barrel in the U.S. only, and outside the U.S. and Canada only, Cheez Whiz.

In addition, Kraft Heinz will partner with Groupe Lactalis on a perpetual license for Kraft in Natural, Grated and International cheeses and Velveeta in Shredded and International cheeses.

Kraft Heinz will retain the Philadelphia Cream Cheese, Kraft Singles, Velveeta Processed Cheese and Cheez Whiz Processed Cheese businesses in the U.S. and Canada, the Kraft, Velveeta and Cracker Barrel Mac & Cheese businesses worldwide, and the Kraft Sauces business worldwide.

“We believe these cheese and dairy businesses will thrive in the hands of a global dairy company like Groupe Lactalis,” said Kraft Heinz CEO Miguel Patricio. “At the same time, the transaction will enable us to build sustainable competitive advantage in businesses where we have stronger brand equity, greater growth prospects and can use our manufacturing scale and consumer-based platforms approach. This is a great example of agile portfolio management at work.”

As outlined in the new Kraft Heinz operating model announced earlier today, platform roles will help guide resource allocation and investment decisions. Kraft Heinz will focus on growth areas and take strategic action where appropriate. This will help to accrete the Company’s growth profile, enhance strategic focus, and create shareholder value.

Under the terms of the agreement, Kraft Heinz will sell production facilities located in Tulare, Calif.; Walton, N.Y.; and Wausau, Wis., and a distribution center in Weyauwega, Wis. These facilities and their employees will continue to operate in ordinary course. Approximately 750 employees will be transferred from Kraft Heinz to Groupe Lactalis.

The cheese businesses being sold contributed approximately $1.8 billion USD to Kraft Heinz’s net sales for the twelve months ended June 27, 2020. The transaction valuation represents an approximate 12x multiple of LTM Adjusted EBITDA(1) for the standalone business. Kraft Heinz expects to use post-tax transaction proceeds primarily to pay down debt.

RBC Capital Markets, LLC served as exclusive financial advisor to Kraft Heinz for this transaction, while Paul, Weiss, Rifkind, Wharton & Garrison LLP served as their legal advisors.

(1) LTM Adjusted EBITDA includes allocated expenses for the standalone business for the twelve months ended June 27, 2020.

Most read news

Other news from the department business & finance

Get the food & beverage industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.

Most read news

More news from our other portals

Last viewed contents

Mondi wins five World Star Awards for innovative packaging solutions in four categories

Mikado x Pedro Alonso: Popular snack brand collaborates with Spanish Netflix series star

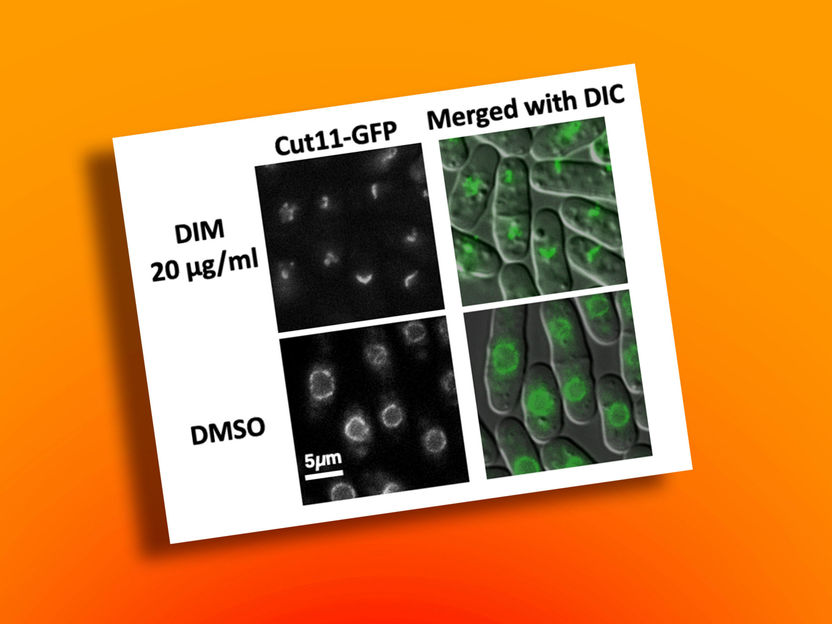

Broccoli compound induces cell death in yeast, offers research path for cancer treatment