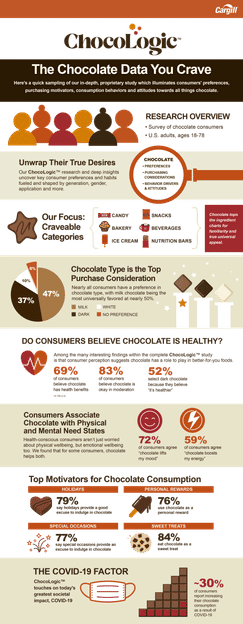

Cargill survey reveals nearly all Americans indulge in a daily chocolate treat

ChocoLogic™ survey unwraps US consumers’ preferences, consumption habits and motivations for enjoying chocolatey foods and beverages

Reaffirming chocolate’s near universal appeal, a new survey from Cargill finds most Americans indulge in a chocolate-flavored treat every day. Viewed as a reward, mood lifter, Energy booster and the secret to surviving a tough day, the company’s ChocoLogic™ research reveals consumers’ preferences, motivations and attitudes toward the decadent ingredient.\

Photo by Pushpak Dsilva on Unsplash

Cargill fielded a proprietary survey to track chocolate’s appeal on its own, and also when incorporated into bakery, beverages, candy, ice cream, salty snacks and snack/nutrition bars. Fielded in February 2021, the survey gathered responses from more than 600 primary U.S. grocery shoppers. For most of these consumers, chocolate flavors are their go-to choice. Across the food and beverage categories included in the survey, respondents admit they choose chocolate-flavored options at least half the time.

“The adage that ‘everyone loves chocolate’ really is true – less than 3% of consumers report avoiding chocolate,” said Gretchen Hadden, Marketing Lead for Cargill’s North American cocoa and chocolate business. “However, while chocolate may be the world’s most beloved ingredient, our research suggests consumers have strong opinions on what they like – and don’t like – about this timeless indulgence.”

Given that most consumers enjoy a daily chocolate treat, it’s no surprise that three in four view chocolate as a way to reward oneself. Other motivations for indulging are less obvious. Seven in ten (72%) agree that chocolate lifts their mood, while 59% say it boosts their energy.

Whatever the reason, more than half (52%) of Americans find chocolate gets them through a tough day. Those perceptions, combined with more at-home snacking occasions, help explain why one in three shoppers report increasing chocolate consumption during the pandemic.

While consumers admit they’ve boosted their chocolate consumption, few register remorse for their indulgence. In fact, consumer perceptions around chocolate suggest it may have an authentic role to play in better-for-you food choices. Nearly seven in ten associate chocolate with health benefits, a characterization even more prominent among consumers of dark chocolate. Perhaps not surprisingly, the survey found this perception is a key purchase driver for dark chocolate, with 52% of consumers choosing it because they believe “it’s healthier.”

The ChocoLogic survey also found interest in premium chocolate remains high, with cacao content, texture and claims around provenance among the cues consumers use to judge quality. Half of consumers consider dark chocolate a more premium choice, 71% notice when chocolate has a grainy, coarse texture; and nearly one in four shoppers perceive chocolate that denotes its cocoa bean origin country as higher quality. This premiumization trend was also evident when consumers were asked about product claims. By far, the most sought claim across all categories was “made with real chocolate,” a factor 84% of shoppers said they were extremely or very likely to consider in their purchase decisions.

While the study reveals 45% of consumers are always looking for new types of chocolate, when it comes to chocolate flavor pairings, classics still win out. Caramel and peanut butter topped the list by a significant margin, with 60% of consumers selecting them in their top three. Behind these time-tested combinations, salty, mint, fruity and coffee/espresso flavors held similar sway – with no single option clearly rising to the top. More novel flavor pairings such as spice, herbal and botanical notes appealed to a much narrower swath of consumers, but did show a slight uptick in interest amongst younger demographics – notably Gen Y and Gen Z.

ChocoLogic insights guide product development

In addition to exploring consumer purchasing considerations and preferences within specific food and beverage categories, the survey’s demographic data adds a valuable layer for Cargill’s customers as they think about creating the perfect chocolatey product to appeal to their end consumer.

“The insights gleaned from this research give us – and our customers – a window into consumers’ attitudes and evolving expectations around this much-loved ingredient,” said Hadden. “It can help guide our thinking on whether to revitalize tried-and-true products or adapt to changing tastes with new-to-the-world innovations, and is one more example of the added value we offer our customers.”