Food companies praised for growing adoption of sustainable protein targets

Despite clear progress, $18 trillion investor engagement warns more must be done by major food firms on sustainable protein transition to combat climate risks in the food system

A five-year investor engagement with 25 leading global food retailers and manufacturers[2] on protein transition finds evidence of clear leadership and reports that the number of firms adopting formal targets to grow their alternative protein offerings is on the rise – growing from 0 in 2018 to 28% of companies in 2021.

Photo by Edgar Castrejon on Unsplash

However, it also warns that the majority (72%) of food companies are yet to adopt protein diversification[3] targets as part of their decarbonization efforts. That’s despite booming consumer demand for meat and dairy alternatives, and recent warnings from the IPCC that atmospheric methane gas has hit an 800,000-year high and “strong, rapid and sustained reductions” in methane emissions (32% of which currently come from livestock) are urgently needed if we are to achieve the goals of the Paris Agreement.

These are some of the key findings from ‘Appetite for Disruption: The Last Serving’, new research launched today by the $40 trillion-backed FAIRR Initiative, which assesses how 25 food companies are responding to the rise of alternative proteins (including both plant-based and cultivated ‘meat’).

Signs of progress praised by investors include:

-

7 of 25 (28%) global food retailers and manufacturers now have targets to expand their alternative protein portfolio, up from zero in 2018. For example, Unilever has committed to reaching $1.2 billion in sales of meat and dairy alternatives between 2025-27.

Five firms (Unilever, Tesco, Nestle, Sainsbury’s, Conagra) are praised for being “pioneers” on sustainable protein research and innovation. See 1 below for a full snapshot of company rankings.

48% of companies now track and publicly disclose their emissions from animal agriculture (Scope 3), up from just 21% in 2019; and 52% of the companies in the engagement now have a net-zero ambition (up from just 8% in 2019).

UK retailers Tesco and Sainsbury’s show global leadership on protein diversification and innovation in contrast to their US and European peers. Tesco has committed to a 300% increase in sales of meat alternatives by 2025, and pledged to halve the environmental impacts of the average basket in the UK. Sainsbury’s has publicly endorsed the need to re-align diets in order to reduce emissions, and has plans to grow the volume of sales of plant-based protein and dairy – following a staggering 40% increase in plant-based diets in the UK in 2020. Both firms also have ambitious science-based targets to reduce their emissions in line with a 1.5-degree pathway. M&S is also highlighted for its partnership with ENOUGH, a mycoprotein start-up, and commitment to increase sales from its Plant Kitchen.

68% of firms have Scope 3 targets for reducing agricultural emissions in their supply chains. Scope 3 emissions represent, on average, 92% of each company’s total GHG emissions, most significantly from animal protein supply chains at both the farm level and in feed production.

However, such is the demand for alternative proteins – which tend to offer a more sustainable alternative to meeting global protein demand than current meat production – that investors warn many companies are still behind the curve, failing to protect themselves from costly climate risks from meat and dairy production, reputational damage and looming regulation on protein transition.

Areas of concern include:

-

72% (18/25) of food brands have yet to establish formal targets to diversify their protein sources despite high consumer demand, showing a lack of clear strategy around a growing market trend and valuable climate mitigation tool. Dollar sales of plant-based foods grew 43% in the last two years, and the US meat and dairy alternatives market grew 300% from 2019 to 2020.

US companies underperform dramatically in comparison with their global peers. Amazon (Whole Foods), Costco and Kraft Heinz are the poorest performers in FAIRR’s ranking (see 1). Leading US retailers Amazon, Costco, Kraft Heinz and Kroger do not report their Scope 3 emissions relating to animal agriculture, a critical measure of the environmental footprint of their meat supply chains. Furthermore, Costco grew its beef sales by 34% in 2020 in contrast to 2019, and does not disclose how it is addressing the environmental impacts of its meat supply. Meanwhile, consumer demand for alternative protein products in North America is soaring: plant-based milk is already purchased by 39% of US households and plant-based food sales rose nearly twice as much as overall U.S. retail food sales last year.

Jeremy Coller, Chair of the FAIRR Initiative and Chief Investment Officer, Coller Capital said:

“As we approach COP26, the impact of agriculture and the largest food companies must be centre stage. 23% of emissions come from agriculture, forestry and associated land use – but plans to address this footprint are notably absent from most national emission reduction plans.

“Food retailers and manufacturers have a vital role to play in the transition to a low-carbon economy, but FAIRR’s report shows that the majority of leading food companies still lack concrete targets to address climate risks in their protein supply chains or to meet booming consumer demand for alternative meat and dairy products.

“Whilst many companies are lagging, we are pleased that FAIRR has seen visible leadership from 28% of the largest food retailers and manufacturers, including leading UK supermarkets, as well as remarkable innovation in sustainable protein. This has been the year of cultivated meat with a record $506 million invested in lab-grown meat alternatives, which is now taking its place alongside plant-based protein on investment agendas.”

2021: The year of cultivated meat

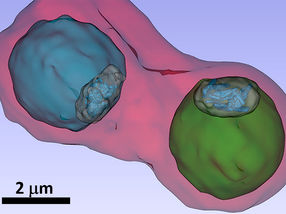

FAIRR’s research also indicates that 2021 is “the year of cultivated meat”. Cultivated meat is animal protein produced by culturing animal cells in a lab and then using a bioreactor to replicate the cell tissue structure of meat. This means these products offer a genuine animal protein source that doesn’t require the slaughter of animals or use of antibiotics in livestock, emits fewer greenhouse gas emissions and uses less water and land.

2021 has already seen two public listings from cultivated meat companies MeaTech (Nasdaq: MITC) and BioMilk (TASE: BMKLK), as well as the world’s first approval for Eat Just’s cultivated meat subsidiary brand, GOOD MEAT to sell cultivated meat on restaurant menus by Singapore’s food agency. In July 2021, food giant Nestlé announced a collaboration with Future Meat Technologies to explore cultivated meat technology. This is the first time a company in FAIRR’s engagement – a large food manufacturer – has partnered with a new entrant start-up in the field of cultivated meat.

Investment in cultivated meat technology also grew sixfold from 2019 to 2020 to reach $360, a total already exceeded in 2021 which so far has seen investment of $506 million into cultivated meat firms. Until now, the conversation on protein transformation has focused on plant-based protein options, yet the rise of cultivated meat looks set to disrupt the market in the years to come.

Policy pathways for protein transition

FAIRR’s report also highlights how European policymakers are increasingly recognising reduced meat consumption and protein diversification as effective climate mitigation and health tools. The UK National Food Strategy recommends a 30% reduction in meat consumption by 2030, Denmark’s dietary guidelines recommend a 30% reduction in meat, whilst France’s recommendations include meat reductions of approximately 28%.

Sustainable protein options will prove crucial to achieving such targets, with the UK government citing “nudging consumers into changing their habits” with regard to protein choices. First-movers on sustainable proteins stand to benefit from such “nudges” as sustainable proteins become a central lever for health and climate agendas.

Jenn-Hui Tan, Head of Stewardship and Sustainable Investing at Fidelity International said:

“The shift towards sustainable proteins will prove an essential tool for addressing serious climate risk, whilst also meeting the demand for nutritious food in a resource-scarce world. We’re seeing increased regulation to facilitate that shift: Canada, Israel, and Singapore have positioned themselves as first-movers in alternative protein development and investment, with Singapore this year becoming the first country in the world to approve cultured meat for sale.

“With other countries poised to follow suit, investors should be aware of the impacts and opportunities within this shift and food companies should be innovating at pace. Fidelity has engaged with a number of food companies on their plans for diversification, and we continue to promote innovative solutions to drive transformation and build resilience against climate change.”

Rebecca White, Responsible Investment Analyst at Newton IM said:

“For the first time, leading food companies are making concrete commitments on protein diversification and innovation. FAIRR’s findings that seven companies in their engagement have now set such targets will come as encouraging news to investors concerned about increasingly material animal agriculture risks within the food system.

“Newton Investment Management Ltd has engaged with both food retailers and manufacturers where we have fixed-income and equity investments on corporate strategies around alternative proteins and product portfolios. But there is still work to do. Companies must continue to mitigate climate risk and meet consumer demand expectations through protein diversification.”