GEA announces medium-term financial objectives

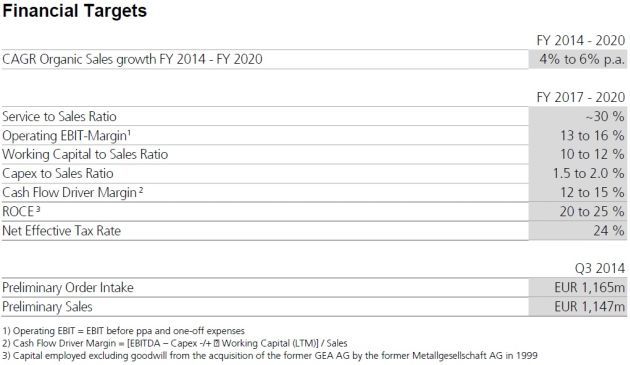

- Future average organic growth in sales of 4-6%

- Operating ebit margin between 13% and 16% from 2017 onwards

- Increase in the dividend payout ratio to 40-50%

- Preliminary order intake in Q3 2014: on par with the previous year at EUR 1,165m

- Preliminary sales in Q3 2014: up 5% on the previous year at EUR 1,147m

Financial targets

GEA Group

Regarding the use of the proceeds from the divestiture of Heat Exchangers that are expected to be transferred before long, the Executive Board reaffirmed its intention to undertake acquisitions in order to strengthen the Group's portfolio by adding applications in the food processing technology sector, and its aim to reduce debt levels in the near future. Furthermore, GEA has decided to sustainably raise its target dividend payout ratio from one third to a level of between 40% and 50%.

"In view of minimum annual savings of EUR 100m from the forthcoming group restructuring process that are expected to materialize as of 2017, we have set ourselves new ambitious medium-term growth and earnings targets. These objectives underline our focus on GEA's sustainable value enhancement“, observed Jürg Oleas, CEO of GEA Group. "Certainly, the planned increase in the dividend payout ratio to between 40% and 50% of our net income will be attractive to our shareholders. Thus, from now on, our shareholders will receive a much higher share of GEA's profits than ever before.“

In addition, GEA also published selected preliminary financial figures for the third quarter 2014. Order intake of EUR 1,165m was on par with the prior-year level. During the same period, sales were up 5% at EUR 1,147m. GEA's guidance for business development in 2014 was confirmed one more time.

Most read news

Other news from the department business & finance

Get the food & beverage industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.