Beverage companies need to innovate and adapt to curb impact of sugar tax in Malaysia

To curb the sharp rise in non-communicable diseases and promote healthier lifestyles, Malaysia’s Ministry of Health is set to impose sugar tax on sugar-sweetened beverages from 1 July 2019. Against this backdrop, it is crucial for the beverage companies to innovate and adapt in line with evolving regulatory landscape and changing consumer preferences, says GlobalData, a leading data and analytics company

GlobalData

As per the sugar tax, an excise duty of RM 0.40 per litre would be levied on soft drinks (including carbonated drinks, flavored and other non-alcoholic beverages) exceeding five grams of sugar per 100 ml, milk-based drinks exceeding seven grams per 100 ml and fruit and vegetable based drinks exceeding 12 grams per 100 ml.

According to GlobalData, per capita consumption of sugar in Malaysia is 60 kilograms and more than 11% of this sugar consumption is being contributed by soft drinks (including juices).

Nabila Azmatulla, Consumer Insights Analyst at GlobalData, says: “Consumers are gradually becoming health conscious and with evolving consumer preferences, companies will need to up their ante in the battle against sugar. Nevertheless, indulgence needs to be core to their offering, that is, healthier options without compromising on the taste.”

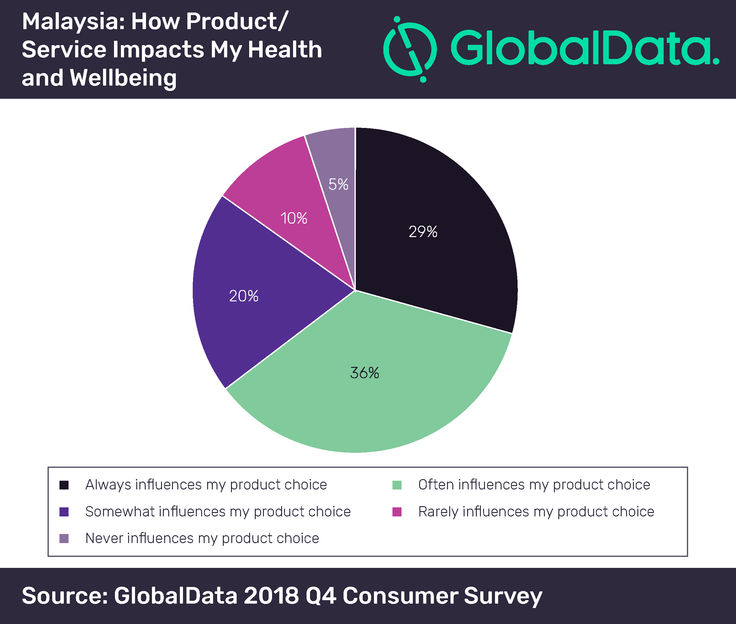

According to GlobalData’s 2018 Q4 consumer survey, 65% of Malaysian consumers say that a product’s impact on their health always/often influences their product choice, which is reflective of the consumer sentiment around health.

As a result, the country’s leading food and beverage company, Fraser & Neave (F&N) Holdings Bhd is looking to reformulate 70% of its products to mitigate sugar-tax impact. F&N has set aside a capital of RM 30 million to produce new products this year to counterbalance the pressure on its bottom line once the sugar tax comes into effect.

In 2018, F&N launched 13 new products as healthier options and they received positive market response. The company is now focusing on innovation with sugar content below 5% without compromising on the taste.

Nabila concludes: “With beverage companies coming under pressure due to additional production costs, evolving consumer preferences and more stringent regulations, they need to build a healthier product portfolio to stay ahead of the competition.”

Most read news

Organizations

Other news from the department business & finance

Get the food & beverage industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.