Heineken N.V. purchases €333 million in shares from FEMSA

Heineken N.V. (HEINEKEN) has purchased from FEMSA approx. 2.5 million shares in HEINEKEN at a price of €92.75 per share (totalling €235 million) and approx. 1.3 million shares in Heineken Holding N.V. at a price of €77.25 per share (totalling €98 million) for an aggregate amount of €333 million.

The purchase is part of the sell-down offering by FEMSA of €2.7 billion in HEINEKEN shares and €1.0 billion in Heineken Holding N.V. shares at the same prices per share, which was successfully completed. HEINEKEN notes that upon completion of the purchase FEMSA will no longer hold any shares in HEINEKEN and Heineken Holding N.V. other than the Heineken Holding N.V. shares underlying the exchangeable bond.

HEINEKEN will fund the share purchase from existing cash resources and credit facilities. The impact on HEINEKEN’s net debt / EBITDA (beia) ratio is expected to be minimal and will be earnings-per-share accretive.

HEINEKEN intends to keep the purchased HEINEKEN shares in treasury and the purchased Heineken Holding N.V. shares on its balance sheet. For further details on the accounting and dividend treatment, please refer to our presentation following the previous purchase of FEMSA shares here.

Heineken Holding N.V.’s position as controlling shareholder in HEINEKEN will not be affected.

Most read news

Other news from the department business & finance

Get the food & beverage industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.

Most read news

More news from our other portals

Last viewed contents

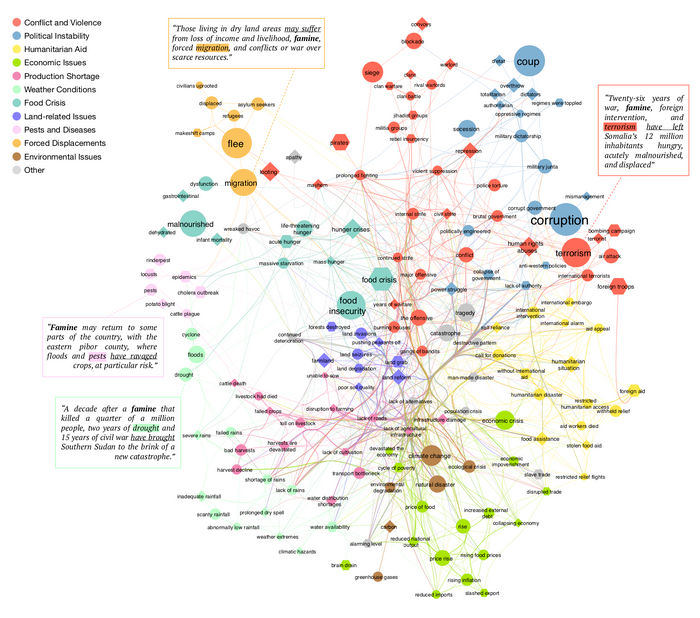

News you can use—to better predict food crisis outbreaks - Machine-learning model analyzes articles’ content and frequency to make precise predictions on where next hunger scourge will occur

Is red wine overrated as a trigger for migraine attacks?

Naturally cloudy apple juices promote intestinal health - Study by the German Sport University Cologne, Leibniz Universität Hannover and the University of Vienna investigates the interaction between drinks and sport